Probate in California

Contents

Probate in California

What is probate?

Probate is a legal proceeding involving a court case following a person’s death which deals with the following:

- Identifying if there is a valid will.

- Valuing any property.

- Identifying any heirs or beneficiaries.

- Dealing with any financial responsibilities the deceased person had.

- Transferring any property to the identified heirs or beneficiaries.

What is the process of probate in California?

According to the Californian Government, there are 5 steps to deal with a deceased person’s estate initially which are:

1) Estate Representative

You need to figure out who will be the ‘estate representative’. The first factor to consider is whether there is a valid will. If so, the ‘executor’ named in the will is the estate representative.

However, if there is no will, it is important for you to consider whether the case needs to go to probate court. A small estate may be best dealt with informally by a close relative or the person who will be inheriting most of the estate. If the case does need to go through a formal probate process, the court will appoint an estate representative.

Remember that you can always seek assistance from a lawyer if there is any disagreement around who should be the estate representative.

2) Duties as Estate Representative

If you are the estate representative, there are various duties you will need to carry out. Your main duty is to ensure that you take care of the estate and ensure distribution of the estate is carried out accurately.

Some further initial duties include, but are not limited to, the following;

Safeguarding the property and ensuring any debts are paid.

Obtaining certified copies of the death certificate.

Cancelling any active credit cards.

Managing any digital assets.

3) Heirs and Beneficiaries

You need to figure out who the heirs and beneficiaries are.

If there is no will, an heir will be a person who has the right to inherit from the estate. If there is a will, any beneficiaries will be named to inherit some of the estate.

There are issues which could make this process more complicated. You may wish to seek advice from a lawyer if you are struggling to figure out who the heirs or beneficiaries are.

4) Inventory

You need to identify and make an inventory of the decedent’s property.

It would be helpful to include the following information on the inventory:

A brief description of each asset.

The value of the asset.

How the asset was owned/the portion the decedent owned.

Whether there are any claims which could be filed against the asset in relation to loans or debt.

5) Transfer Process

You need to figure out the best transfer process for the assets. This will all depend on the estate, as if a simplified process is not advisable the estate might need formal probate.

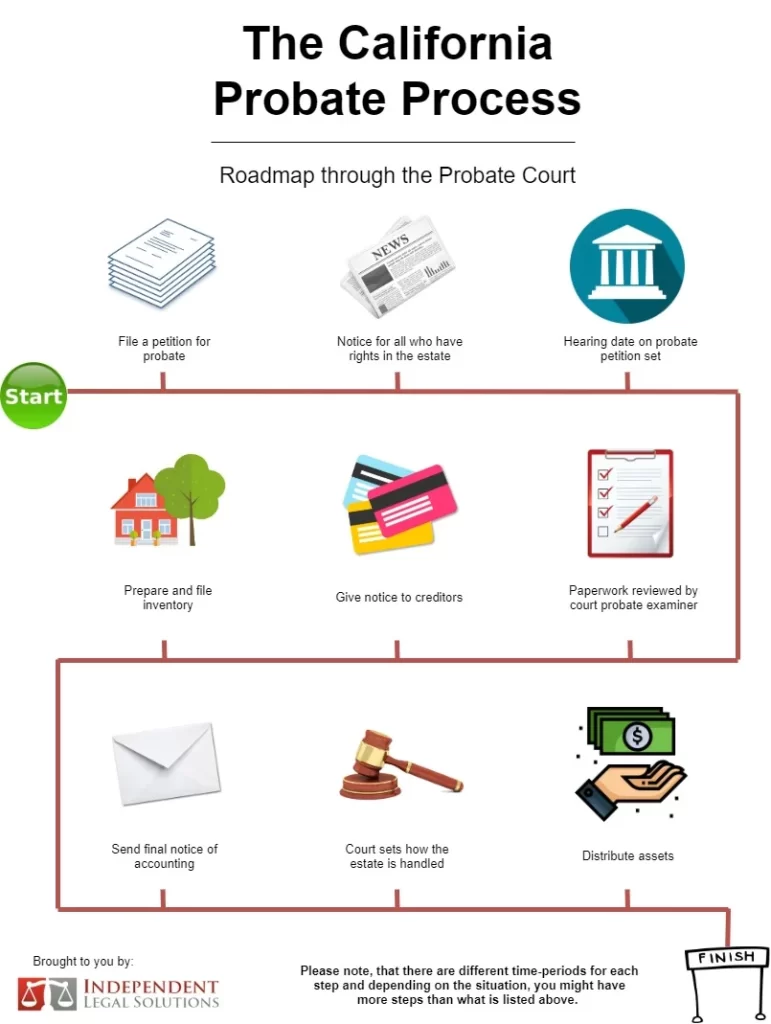

If formal probate is required, these are the more specific steps to take:

1) Once a person has died, the person who has the will at the time of death needs to either take the original will to the probate court clerk’s office or send a copy of the will to the executor within 30 days.

2) If probate is required, you will need to file a petition for probate (DE-111 form) within the county the person lived in before their death. If you file the petition, you will be known as ‘the petitioner’.

3) Once the above is complete, a hearing date will be set. Notice must be given to anyone who may have any right to some part of the estate.

4) The paperwork will all be reviewed by a court probate examiner to ensure it is accurate and the court will then appoint an estate representative.

5) An inventory will need to be prepared using the Inventory and Appraisal Form (DE-160) and filed with the court. Any non-monetary assets will need to be valued by a probate referee.

6) Once identified, the assets will be distributed. If any real estate needs to be sold, a report of sale and petition for order confirming sale of real property needs to be filed with the court. If the estate has earned any income, an estate tax return will need to be filed and a final income tax return prepared for the deceased.

7) Following any filed taxes, a final plan and accounting should be filed with the court which will set out how the estate was handled. As long as the court is happy with this, you will be released from any obligations.

What is the process of probate without a will?

If there is no valid will, the court will seek to distribute the estate under California’s intestate succession laws. Under these laws, the court can appoint an administrator to manage the estate during the probate process. If you wish to be the administrator, you should file a Petition for Letters of Administration Form DE-111 which can be accessed here https://www.courts.ca.gov/documents/de111.pdf.

What is the cost of probate in California?

There are statutory fees in California for probate prescribed by code §10810 based on the value of the estate. These fees are the maximum fees attorneys and executors can charge for probate:

4% of the first $100,000

3% of the next $100,000

2% of the next $800,000

1% of the next $9,000,000

0.5% of the next $15,000,000

How to avoid probate in California?

Probate can be a costly and time-consuming process which you may wish to avoid where possible.

Even though it is likely that some or most of the deceased person’s property will need to go through probate, there are certain situations where this process is not required including with:

Any assets held in joint tenancy has a different process.

Any community property.

Any financial assets which names a beneficiary e.g. bank account.

Any assets held in trust.

The final point above is one of the best ways to avoid probate by creating a living trust before you die.